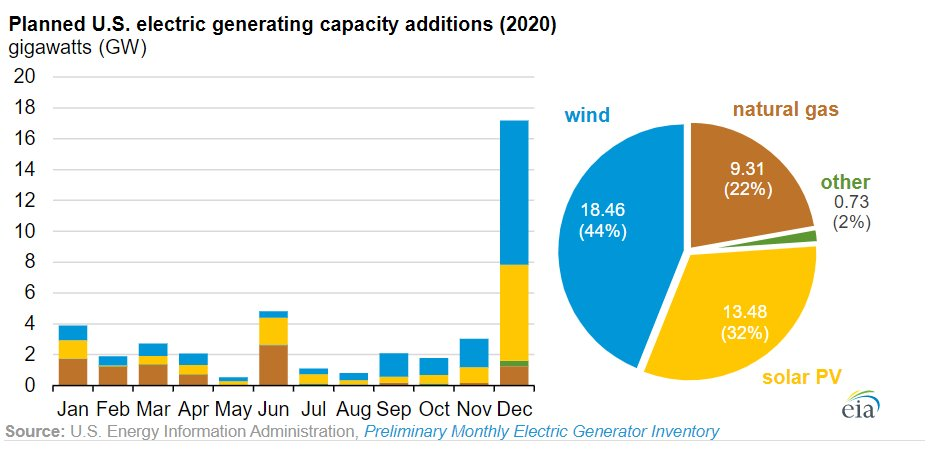

The rise of renewable energy over the past decade has been staggering. Whereas ten years ago wind and solar were expensive niche players in the electricity mix, this year they could represent more than three quarters of new electricity generation capacity, due primarily to their newly superior economics.

Despite much hand-wringing about the failures of Cleantech 1.0 and the challenges of scaling a business in the energy sector, the growth of these technologies spawned multiple categories of successful companies over the past decade. Among them:

- Residential solar pioneers — Sunrun, Vivint Solar, Sunnova, SolarCity (all IPOs)

- Differentiated system technology providers — NextTracker (acquired by Flex), SolarEdge (IPO), Enphase Energy (IPO), Zep Solar (acquired by SolarCity)

- Utility-scale project developers — Recurrent Energy (acquired by Sharp), sPower (acquired by AES), Geronimo Energy (acquired by National Grid)

- Early suppliers of grid flexibility — EnerNOC (IPO, acquired by Enel), Nest (acquired by Google), Greensmith (acquired by Wartsila), Sonnen (acquired by Shell)

But the hard work has only just begun. Zero-carbon sources comprised around 36% of all generation in the U.S. last year, of which wind and solar combined for just 11% (the remainder was largely hydro and nuclear). Meanwhile, a dizzying array of actors — including states, utilities, cities, and enterprises — are setting goals of 100% clean or renewable energy by midcentury or sooner.

In order to fully (or nearly) decarbonize the grid, especially absent a game-changing technology like nuclear fusion, we will need a massive mobilization of technology and capital for decades.

Here’s a rough idea of what might be in store as we decarbonize the grid over the coming decades (all back-of-the-envelope math; come at me, energy nerds):

- As a baseline, to build out enough wind and solar* to decarbonize the current U.S. grid, we would need to increase their combined capacity nearly 5X (from ~200 GW to >900 GW). This alone would mean the mobilization of, say, $700 billion of capital (assuming $1/watt across technologies and markets).

- But in fact, we’ll simultaneously be hoping to decarbonize the rest of the economy in part by electrifying other sectors — chiefly transportation, but potentially also space heating and industrial processes. If all those sectors were fully electrified (a tall order, to be sure), they would nearly double total electricity load in the U.S. And so in order to decarbonize while fully electrifying, we would instead need up to ~2,000 GW of renewables and ~$1.8 trillion of capital investment (not even accounting for the capital required for added transmission and grid infrastructure).

- Assuming this decarbonization is achieved primarily through wind and solar*, we would face an enormous amount of what I call “grid weirding” — higher volatility in electricity prices, periods of negative pricing/curtailment, fast-ramping load requirements, seasonal swings, high weather-driven variability, etc. Each of these bits of weirding will be a challenge that requires further investment in grid flexibility resources — energy storage, demand flexibility, and flexible zero-carbon generation.

- Meanwhile, assuming climate change continues to worsen, we’ll see rising temperatures, increased frequency and magnitude of natural disasters, and an upwelling of demand — both from consumers and enterprises — for solutions that support greener choices and provide climate resilience.

*While wind and solar are on the clearest path to massive scale, I should note the exciting prospects for so-called “baseload zero-carbon resources” like next-generation geothermal and nuclear, any of which could help mitigate grid weirding.

This will be a monumental challenge. Fortunately, a rich ecosystem of startups has already emerged to tackle many of the component issues, from making cheaper renewable systems through integrating them on the grid:

We at Energy Impact Partners have already invested in a number of companies driving this transformation, including those who sell clean power (Arcadia), those who deploy flexible resources (ecobee, Enchanted Rock) those who finance and maintain those resources for homes and businesses (Mosaic, Sparkfund), and those who help manage them on the grid (Autogrid, Opus One, Innowatts, Sense).

But the opportunity here is enormous, and there is much innovation still to come. Here are a few additional areas where I believe there will be significant value creation over the next few years:

- Tools to better serve enterprises — Companies have emerged as key actors driving the energy transition, and there will be big opportunity both in helping them procure clean energy and in automating/improving their sustainability and ESG accounting and actions.

- Solutions to mobilize and direct sustainable capital flows — There are enormous volumes of capital newly dedicated to sustainable assets; they’ll need help finding a suitable home.

- Viable solutions to accelerate bulk power replacement cycles without significant ratepayer impact.

- Scalable ways for monetize demand flexibility while maintaining a delightful customer experience. We estimate that flexible customer-sited resources (electric vehicles, thermostats, batteries, smart water heaters, etc.) could shift up to 30% of peak electricity demand in five years — but getting them to actually do so will be the hardest and most rewarding challenge.

- Brands that unlock pent-up consumer demand for conscious consumption, particularly around climate change, via carbon transparency and easy, trustworthy lifestyle greening.

- Business models that combine resilience with grid flexibility, particularly at the residential level.

And more. There are opportunities in better weather analytics, long-duration energy storage, green hydrogen, heating electrification, GHG tracking/monitoring, power market forecasting, and on and on.

I’ve been heartened over the past year to see an impressive new guard of innovators enter the space, hoping to make their mark on the planet. With any luck, they’ll succeed.

Shayle Kann (@shaylekann) is Managing Director at Energy Impact Partners, a $1.2 billion venture capital fund backed by a coalition of the world’s leading energy companies. Get in touch: [email protected].